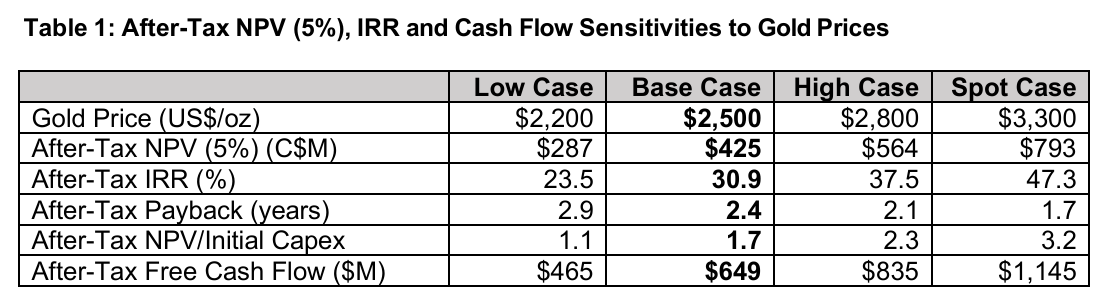

After-Tax NPV (5%) of $425 Million with an After-Tax IRR of 30.9% at US$2,500 / oz Gold

After-Tax NPV (5%) of $793 Million with an After-Tax IRR of 47.3% at Spot Gold (US$3,300 / oz)

Vancouver, B.C. – July 21, 2025 – Canagold Resources Ltd. (TSX: CCM, OTC-QB: CRCUF, Frankfurt: CANA) (“Canagold” or the “Company”) is pleased to announce positive results of the Feasibility Study (“FS”) for its 100% owned New Polaris gold-antimony project located in northwest British Columbia, Canada. All dollar figures are in Canadian dollars unless otherwise indicated. The Company expects to file a technical report relating to the FS, prepared in accordance with National Instrument 43-101 (“NI 43-101”), within 45 days.

Feasibility Study Highlights

Robust Project Economics

- After-tax net present value (“NPV”) of $425 million generating an after-tax internal rate of return (“IRR”) of 30.9%, with a project payback of pre-production capital expenditures (“CAPEX”) of 2.4 years, assuming a discount rate of 5.0% and a US$2,500 base case Gold Price per ounce (“Gold Price”)

- After-tax NPV of $793 million generating an after-tax IRR of 47.3 %, with a project payback of pre-production CAPEX of 1.7 years, assuming a discount rate of 5.0% and a US$3,300 spot Gold Price

- Life of mine (“LOM”) after-tax free cash flow of $649 million at a US$2,500 base case Gold Price

- LOM after-tax free cash flow of $1.1 billion at a US$3,300 Spot Gold Price

High Grade, Low CAPEX and Low AISC

- Estimated pre-production capital expenditures CAPEX of $250 million

- LOM all-in sustaining cost (“AISC”) per payable gold US$1,247/oz.

- High-grade underground mine averaging a LOM diluted grade of 9.94 g/t gold containing 904,000 ounces of Gold

- LOM mill recovered gold production of 805,589 ounces

Feasibility Study Financial Highlights and Gold Price Sensitivity

“The Feasibility Study results demonstrate exceptional economics, low Capex and low AISC for the New Polaris Gold-Antimony Project,” stated Canagold’s Chief Executive Officer, Catalin Kilofliski. “Even at a $2,500 Gold Price, the projected cash flow and economics are outstanding. While we continue to refine and optimize the Project aimed at unlocking additional revenue from antimony metal and reduction of power costs and emissions through potential run-of-river green power generation, our primary focus is now shifting toward completing the permitting process, in order to advance New Polaris toward a construction and production decision. I would like to express our sincere appreciation to the Taku River Tlingit First Nation for fostering a respectful and inclusive open dialogue every step of the way. I also want to thank all our shareholders for their patience and confidence.”

TRTFN’s Spokesperson, Charmaine Thom, says “Canagold’s land acknowledgement of Taku River Tlingit First Nation’s traditional territory and the willingness to work toward a partnership through a Consent Based Agreement, is a true testament of what reconciliation looks like.”

Critical Metals/Antimony

- A total of 5,630 tonnes of Sb grading 0.6% is included in the Company’s Indicated MRE dated April 2, 2025

- A total of 5,173 tonnes Sb is included in the FS mine plans

However, the Feasibility Study does not include any revenue contribution from antimony or estimate an antimony reserve. This is because the process flowsheet outlined in the Feasibility Study is specifically designed to produce a sulphide concentrate.

Antimony has been recognized at New Polaris since the early mining operations of the 1940s and 1950s. However, its economic significance has grown substantially in recent years due to global supply shortages and sharply rising prices.

The Company is currently undertaking additional metallurgical testing and economic evaluations required to support the inclusion of antimony in the project’s financial model.

The prospect of including revenue from antimony in future phases, has the potential to improve overall project economics, particularly as the associated mining costs for antimony are largely covered by the gold mining activities. However, there are no guarantees that the future testing will support this prospect.

Plans for Unlocking Antimony Value

To capitalize on the full economic potential of antimony, the Company is advancing several key initiatives:

- Metallurgical Test Work: Ongoing advanced testing to produce a high-grade antimony-gold concentrate

- Refining and Processing Studies: Technical assessments evaluating the feasibility of refining antimony into high-purity metal prior to off-site gold refining

- Economic Optimization: Evaluating the potential uplift in project economics from the future inclusion of antimony revenue

- Exploration Upside: Assessing opportunities for expanding antimony mineralization within the broader New Polaris property

New Polaris Feasibility Study

The Feasibility Study for New Polaris was completed by Ausenco Engineering Canada ULC (“Ausenco”), supported by Moose Mountain Technical Services and JDS Energy & Mining Inc. The study confirms robust economics for an underground mining and milling operation, with a low initial capital cost and a high rate of return.

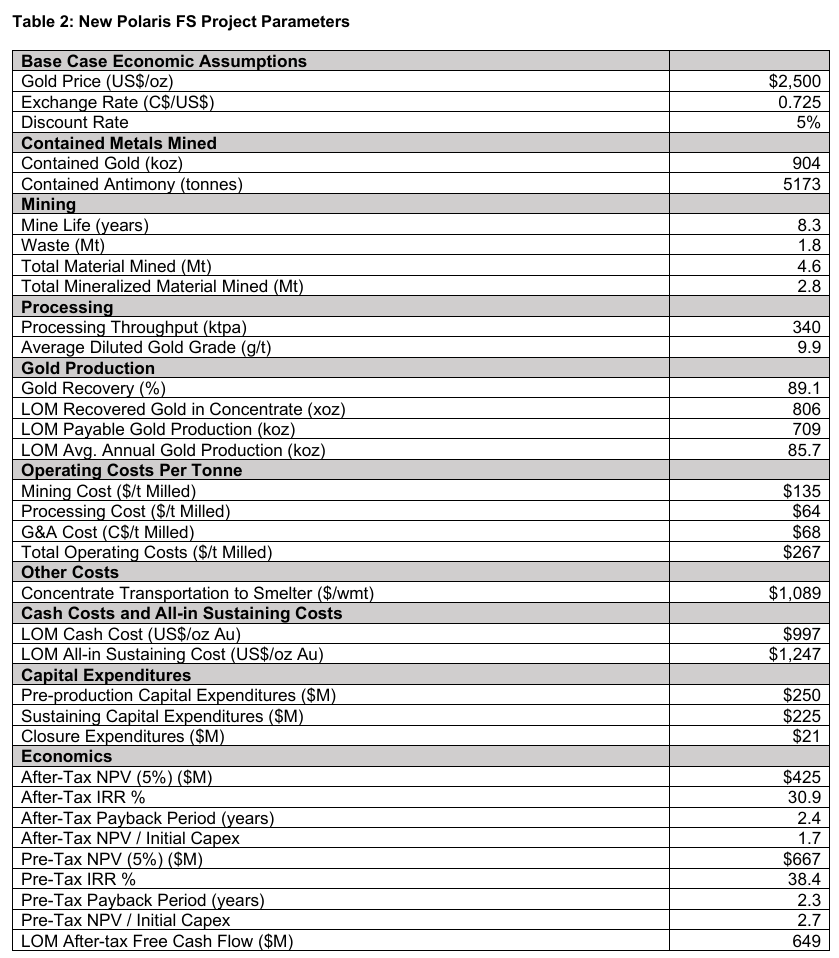

Key Feasibility Study parameters are shown in Table 2.

- Cash costs are inclusive of mining costs, processing costs, site G&A, off-site charges and royalties

- AISC includes total cash cost, sustaining CAPEX and closure cost

- All dollar ($) figures are presented in CAD unless otherwise stated. Base case metal price used in this economic analysis is US$2,500 /oz Au.

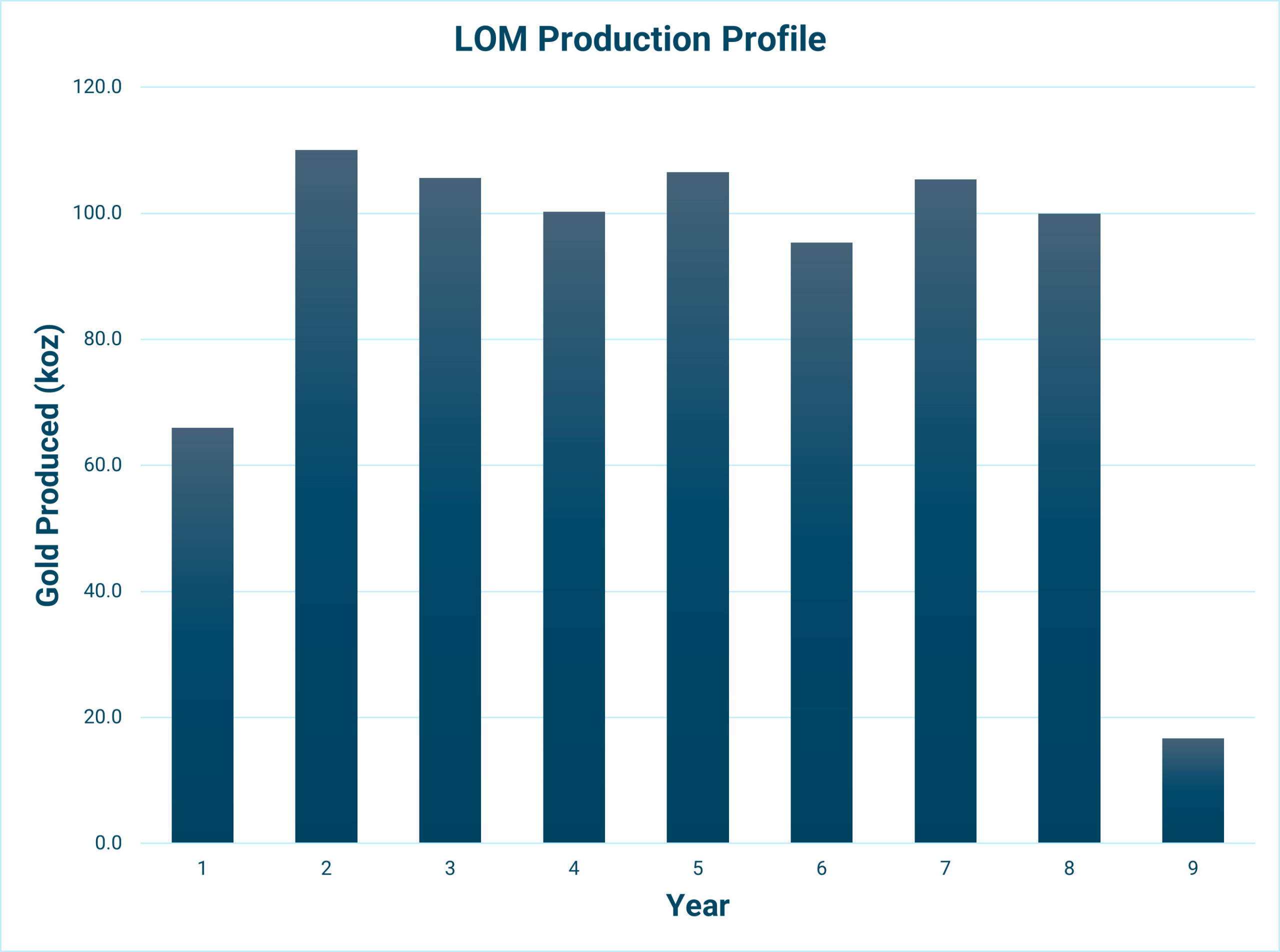

Gold Production Profile

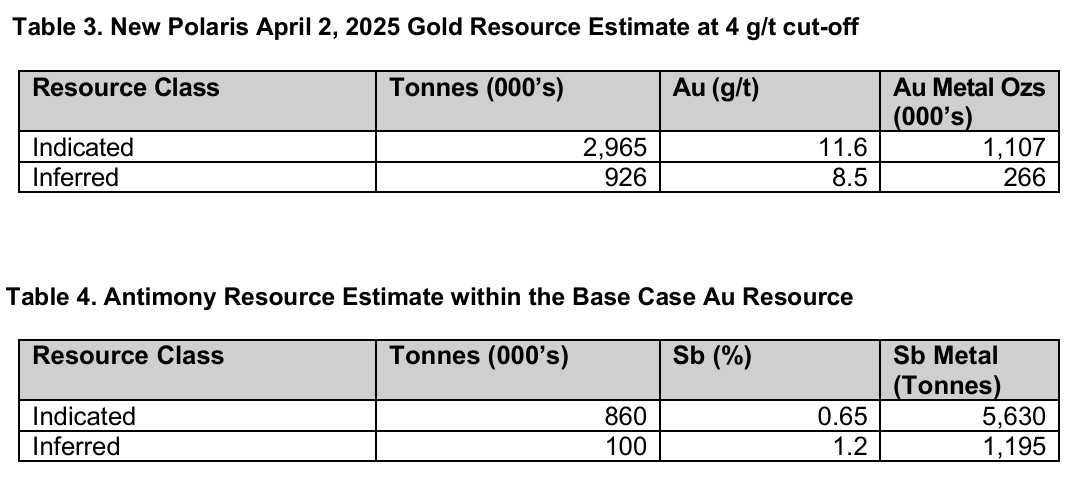

Mineral Resource Estimate

The Company’s current Mineral Resource Estimate (“MRE”), completed by Moose Mountain Technical Services, has an effective date of April 2, 2025 with the mineralization model as the basis for the FS. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability at this time.

The New Polaris Mineral Resources for gold and antimony are shown in Table 3 and Table 4.

Notes on the Resource Tables:

- The Mineral Resource Estimate was completed by Sue Bird, P.Eng. who is a Qualified Person as defined under NI 43-101.

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines.

- The base case Mineral Resource has been confined by “reasonable prospects of eventual economic extraction” shape using the following assumptions:

- Metal prices of US$1,750/oz Au and Forex of 0.75 $US: $CDN

- Payable metal of 99% Au

- Offsite costs (refining, transport and insurance) of US$7/oz

- Mining cost of CDN$82.78/t

- Processing costs of CDN$105.00/t and G&A and site costs of CDN$66.00/t

- Metallurgical Au recovery of 90.5%

- The resulting Net Smelter Return per tonne of ore equation is: NSR (CDN$/t) = Au (g/t) x 90.5% x C$74.72 /g Au.

- The specific gravity is 2.81 for the entire deposit.

- The Antimony Resource is reported as a subset of the total Mineral resource at the 4 g/t Au cutoff.

- The Sb is a by-product of the Au processing and therefore is reported using the same Classification as the Au resource at the 4 gpt Au cutoff.

- Numbers may not add due to rounding.

About the Mineral Resource Estimate

- A comprehensive statistical review of all available QA/QC assay data from the drilling was undertaken as part of the MRE

- Historic drill results have been validated with recent drilling

- Gold values were capped for each individual domain of the geological model based on statistical probability plots

- The MRE is based on a 5 m block model using a Percentage Model (meaning that the percentage of the block within the domain is used for the MRE)

- A constant specific gravity of 2.81 g/cc is used for all blocks in the model, based on an average of measured sample SG’s

- Indicated classification of a block required either 1) average distance to two drill holes of 35 m, maximum distance 50 m and minimum number of two quadrants, or 2) average distance to two drill holes of 50 m, maximum distance 70 m and minimum number of two quadrants, or 3) distance to closest drill hole of 10 m, maximum distance of 50 m used and minimum number of three drill holes used

- The classification was checked for cohesiveness, with a cohesive shape of Indicated and Inferred material produced

- The base case cutoff grade of 4 gpt Au is based on a US$1,750/ounce price of gold and preliminary recovery, processing and mining costs which are based on preliminary production rate values as summarized in the Notes to the resource table

- The MRE table presents undiluted values of gold grade and contained gold ounces

- The following factors, among others, could affect the MRE: assumptions used in generating confining shapes, stope design; mining methods; metal recoveries, mining and process cost assumptions and commodity price and exchange rate assumptions. The QP is not aware of any environmental, permitting, legal, title, taxation, socioeconomic, marketing, political, or other relevant factors that could materially affect the MRE

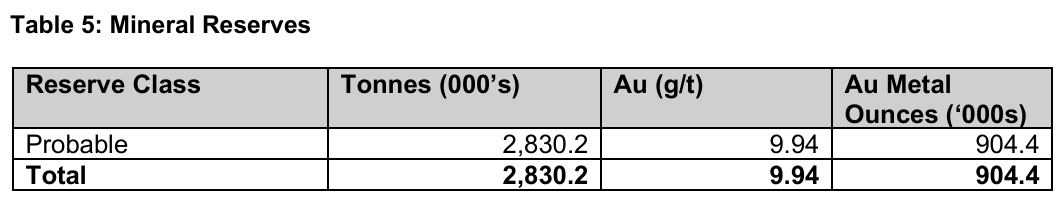

Mineral Reserve Estimate

The mineral reserves are summarized in Table 5.

Notes on the Reserve Table:

- This Mineral Reserve Estimate has an effective date of July 10, 2025 and is based on the updated Mineral Resource estimate issued on February 21, 2025 by Moose Mountain Technical Services.

- The Mineral Reserve estimate was completed under the supervision of Dino Pilotto, P.Eng. of JDS Energy and Mining Inc., who is a Qualified Person as defined under NI 43-101.

- A cut-off grade of 6.0 g/t Au was used to define reserves for production and a 4.2 g/t Au marginal cut-off value for development ore, based on a gold metal price of U$2,245/oz., exchange rate of CAD$1.39 = US$1.00.

- Processing costs of C$88/t ore, C$105/t mining costs, G&A costs of C$67/t ore, gold processing recovery of 89.75%, and payable gold of 90%.

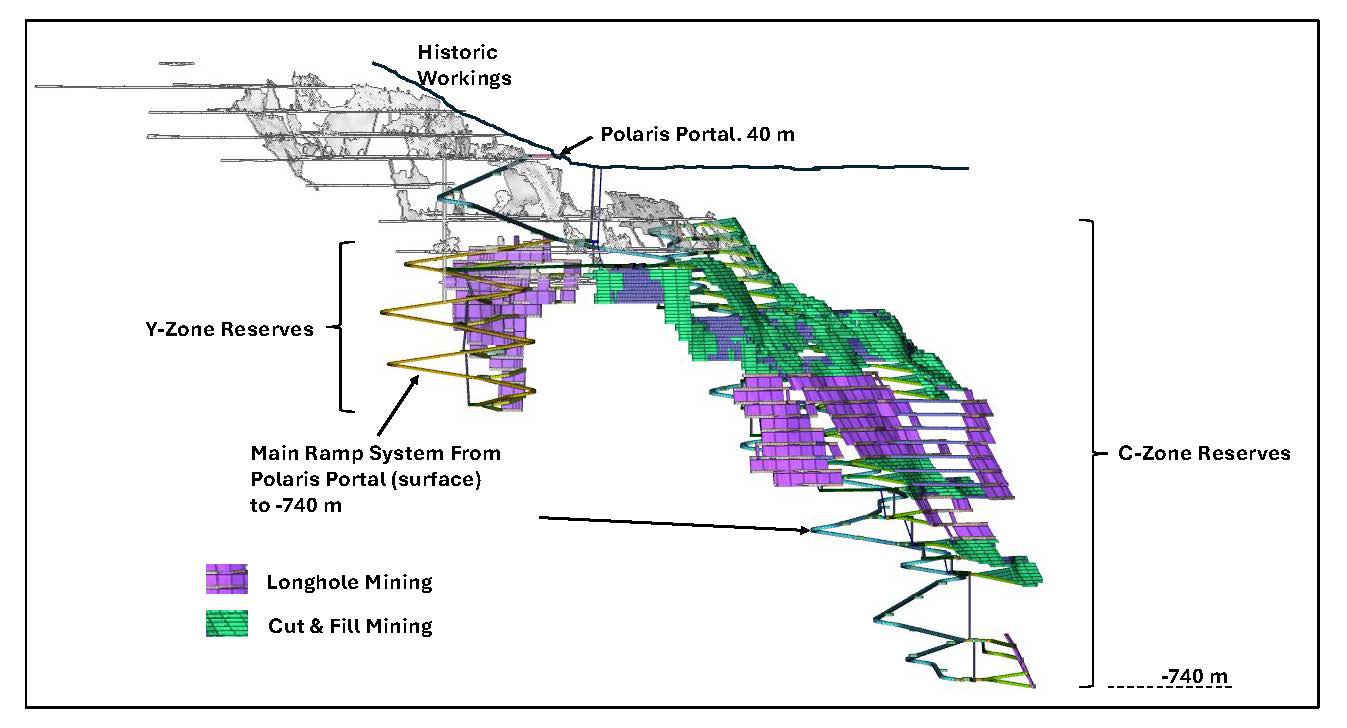

Mining Overview

The New Polaris mine is designed as a modern, fully-mechanized underground operation, targeting the safe and cost-effective extraction of mineral reserves over an estimated 8.3 year mine life. The plan anticipates delivering approximately 2.8 million tonnes (Mt) of mill feed at an average grade of 9.9 g/t gold.

A total of 1.8 Mt of waste rock will be generated during LOM underground development. Of this, the majority will be used as backfill material within the mine to support mined-out areas, with the remaining volume placed on surface in the integrated tailings and waste rock storage facility.

The mineral reserves are located beneath the historic workings of the Polaris-Taku mine, which operated from 1938 to 1951 and produced 740,000 tonnes at an average grade of 10.3 g/t gold. The new underground access will be established via a ramp extending from the existing New Polaris portal, reaching an ultimate depth of approximately 780 meters. The primary ore body, known as the ‘C’ zone, accounts for nearly 90% of total reserves, extends up to 500 meters along strike, and dips at an average angle of 50 to 60 degrees.

Geotechnical assessments indicate favorable rock conditions, with typical ground control measures and associated costs anticipated.

To optimize recovery and minimize costs, two main mining methods will be employed:

- Mechanized cut-and-fill mining will be used in areas where high selectivity, minimal dilution, and strong recovery rates yield the greatest value

- Sublevel long-hole mining will be applied in zones where its inherently low unit cost delivers optimal economic benefit

Mine development and early construction activities will be carried out by an experienced underground mining contractor, with operations transitioning to an owner-operated model upon commencement of production. The underground mine is expected to employ approximately 190 personnel, sustaining an average production rate of 950 tpd throughout the mine’s operating life.

Processing Overview

Processing will occur in a 1000 tpd crushing, grinding and flotation plant to produce a bulk sulphide flotation concentrate which will be shipped off site for final processing at an independent processing facility.

Crushed ore is ground to 80% minus 74um and fed into a flotation circuit consisting of one stage of rougher flotation with two cleaning stages to produce concentrate grading > 100 g/t Au.

Flotation concentrate is thickened, filtered and dried, to a moisture of approximately 5% and flown to Juneau, Alaska, which is located approximately 60 km from site, then barged to Seattle for loading onto ocean going ships for transportation to third-party smelters worldwide.

A portion of the process tailings will be fed to a backfill plant and used for filling underground mining voids, the balance will be filtered and trucked to a dry-stack storage facility located about 1 km from the plant site. Waste rock not used for underground backfilling will also be trucked to this facility for storage with the tailings.

Concentrate Marketing Study

An independent concentrate marketing study for the New Polaris Project, evaluating marketability and treatment terms for its gold concentrate has been completed as part of the FS. The study confirms that the New Polaris gold concentrate, targeted at a grade exceeding 100 g/t Au, and an average 12% As, is marketable under current global conditions.

The report identifies potential outlets for the sale of New Polaris gold concentrate, including:

- Traditional gold roasters in Asia, which represent an established and high-capacity processing route

- Blending facilities, where the concentrate can be mixed with other materials prior to shipment to smelters

- Asian gold roasters, copper smelters, or lead smelters

- Direct sales to international metal trading firms, which offer flexible and liquid off-take arrangements

- Pressure oxidation (POX) plants

Based on indicative commercial terms provided by several prospective buyers, the marketing study validated the project’s financial modeling assumptions related to treatment charges and gold payability. The analysis concluded that an average net smelter return (NSR) of 87.9% for gold is reasonable over the LOM and reflects treatment charges associated with the presence of As in the concentrate.

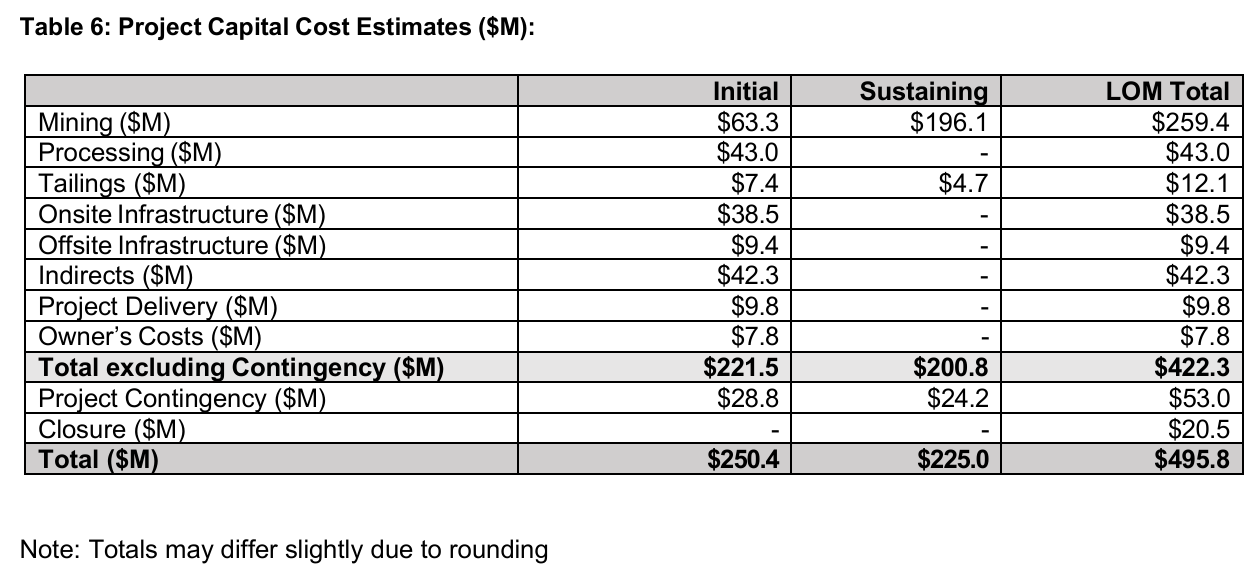

Capital Costs

The initial capital cost is estimated at $250M (US$181M) and shown in Table 6.

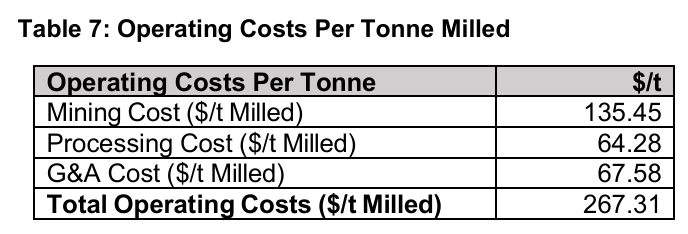

Operating Costs

The LOM Total Cash Cost is US$997/oz Au payable while the LOM AISC is US$1,247/oz Au payable.

Unit Operating costs are shown in Table 7.

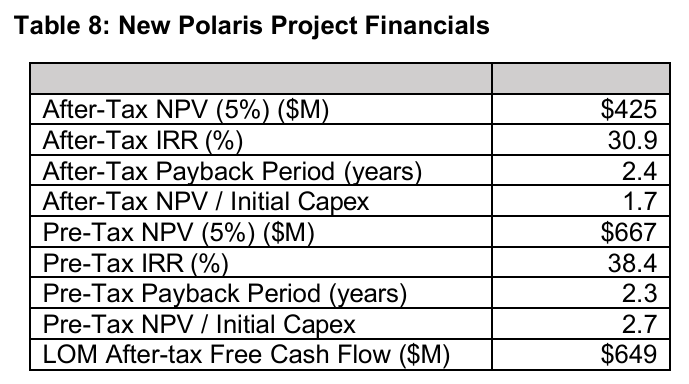

Financial Analysis

At a US$2,500 base case gold price and a C$:US$ exchange of 0.725:1, the Project generates an after-tax NPV (5%) of $425 million and IRR of 30.9%. Payback on initial capital is 2.4 years.

The Project Financials are shown in Table 8.

Regulatory and Environmental Assessment Process

The Project is subject to a range of regulatory approvals, including a consent decision from the Taku River Tlingit First Nation (TRTFN) and an Environmental Assessment Certificate (EAC) under British Columbia’s Environmental Assessment Act. Once the environmental assessment process is completed, the necessary construction and operating permits may be applied for and issued in accordance with applicable provincial and federal legislation.

The project formally entered the BC Environmental Assessment (EA) process in 2023. In September 2024, the British Columbia Environmental Assessment Office (BCEAO) issued a Readiness Decision, concluding there is sufficient information to proceed with the Environmental Assessment Application. Canagold’s consulting team is currently preparing the required technical studies and supporting documentation, with the EA application targeted for submission in the fourth quarter of 2025.

The ongoing involvement, input, and support of the TRTFN have been instrumental in ensuring that their interests are recognized and addressed throughout the process. Their collaboration continues to play a critical role in helping advance and streamline the regulatory review.

Indigenous Relations and Community Engagement

The New Polaris Project is located within the territory of the Taku River Tlingit First Nation (TRTFN).

Canagold has maintained a long-standing and respectful relationship with the TRTFN, having operated within their traditional territory since 1990. Over the years, the Company has built a strong foundation of collaboration and trust with the Nation. A formal engagement framework is in place, guiding communication, consultation, and permitting activities in alignment with TRTFN values and governance structures.

In February 2023, Canagold and the TRTFN established a Technical Working Group (TWG) to facilitate focused collaboration on the New Polaris Project. Bi-weekly meetings have been held consistently, allowing for in-depth discussions on all aspects of the project. In addition, several open houses and community engagement sessions have been conducted to ensure transparent and inclusive dialogue with TRTFN citizens.

Canagold remains firmly committed to continuing meaningful engagement with Indigenous communities, both in Canada and Alaska, as the project progresses.

Opportunities to Enhance Project Value and Reduce Carbon Footprint

The 2025 FS clearly demonstrates that New Polaris is an economically viable project.

Several key opportunities have the potential to significantly increase the economic value of the New Polaris Project while simultaneously reducing its environmental impact:

- Antimony Recovery Optimization: Ongoing metallurgical test work aims to optimize flotation and refining conditions for antimony. Successful antimony recovery and processing could unlock substantial additional revenue

- Renewable Energy Integration: An engineering study is underway to assess the feasibility of constructing a run-of-river hydroelectric facility on-site. This project could replace a significant portion of diesel-generated power, leading to a major reduction in CO₂ emissions and a corresponding decrease in energy costs—ultimately contributing to lower operating expenses

- Resource Expansion Potential: The mesothermal gold deposit remains open at depth and along strike, offering potential for resource expansion beyond the current 8.3-year mine life outlined in the Feasibility Study. In addition, 2024 drilling north of the historic mining area intersected multiple mineralized veins, further supporting the opportunity to increase the defined resource base

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Garry Biles, P. Eng., President & COO is the Qualified Person for the Company and has prepared, validated, and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting activities on its projects.

Sue Bird, M Sc., P.Eng., V.P. of Resources and Engineering at Moose Mountain Technical Services, an independent Qualified Person as defined by NI 43-101. Sue has also reviewed and approved the technical information about the 2025 MRE resource contained in this news release.

Tommaso Roberto Raponi, P. Eng., Principal Metallurgist with Ausenco Engineering Canada ULC., is an independent Qualified Person as defined by NI 43-101 and has reviewed and verified the contents of this news release. Mr. Raponi is responsible for mineral processing and metallurgical testing in the technical report.

Kevin Murray, P. Eng., Principal Process Engineer for Ausenco Engineering Canada ULC., is an independent Qualified Person as defined by NI 43-101 and has reviewed and verified the contents of this news release. Mr. Murray is responsible for processing, process and infrastructure capital and operating cost estimation, financial analysis and marketing in the technical report.

James Millard, P. Geo., Director, Strategic Projects with Ausenco Sustainability ULC., a wholly owned subsidiary of Ausenco Engineering Canada (“Ausenco”) is an independent Qualified Person as defined by NI 43-101 and has reviewed and verified the contents of this news release. Mr. Millard is responsible for the sections and subsections related to environmental, permitting, and social and community aspects in the technical report.

Jonathan Cooper, MSc., P.Eng., Water Resources Engineer with Ausenco Sustainability ULC., a wholly owned subsidiary of Ausenco Engineering Canada (“Ausenco”) is an independent Qualified Person as defined by NI 43-101 and has reviewed and verified the contents of this news release. Mr. Cooper is responsible for the sections and subsections related to site-wide water management in the technical report.

Dino Pilotto, P. Eng., General Manager, Technical Services with JDS Energy & Mining Inc., is an independent Qualified Person as defined by NI 43-101 and has reviewed and verified the contents of this news release. Mr. Pilotto is responsible for mining methods in the technical report.

Mike Levy, P. Eng., Geotechnical Manager with JDS Energy & Mining Inc., is an independent Qualified Person as defined by NI 43-101 and has reviewed and verified the contents of this news release. Mr. Levy is responsible for the underground geotechnical assessment in the technical report.

About Canagold

Canagold Resources Ltd. is an advanced development company dedicated to advancing the New Polaris Project through feasibility, permitting, and production stages. Additionally, Canagold aims to expand its asset base by acquiring advanced projects, positioning itself as a leading project developer. With a team of technical experts, the Company is poised to unlock substantial value for its shareholders.

Catalin Kilofliski, Chief Executive Officer

CANAGOLD RESOURCES LTD

Catalin@canagoldresources.com, 604-685-9700

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking information” and “forward-looking statements” (“collectively forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; and other statements regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs (sustaining and non-sustaining) and operating costs, including projected cash operating costs and AISC,; future or estimated mine life, metal price assumptions, ore grades or sources, gold recovery rates, , throughput, ore processing; statements regarding anticipated future plans, development, construction, permitting and other activities or achievements of Canagold; and including, without limitation: planned gold production; the results and estimates in the FS, including the project life, average annual gold production, total gold production, processing rate, capital cost, net present value, after-tax net cash flow and payback; and the potential to develop the New Polaris Project as an underground gold mine. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond Canagold’s control, including risks associated with or related to: the volatility of metal prices and Canagold’s common shares; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in Canagold’s feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; the availability of financing; financing and debt activities, including potential restrictions imposed on Canagold’s operations in Canada; community support for Canagold’s operations

Canagold’s forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to Canagold’s ability to carry on current and future operations, the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the availability and cost of inputs; the price and market for gold and antimony; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits from government and First Nations; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Canagold’s forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date hereof. Canagold does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.