Additional High Grade Drill Results From New Polaris Property, B.C. Shareholders Re-Elect Board of Directors

July 5, 2006

Vancouver, Canada - Canarc Resource Corp. (CCM: TSX and CRCUF: OTC-BB) reports that additional high grade drill results have been intersected in the Phase 3 infill drill program on the New Polaris property in northwestern B.C.

Drilling highlights include 23.0 gpt gold over 3.8 m (0.67 oz per ton over 12.5 ft) in hole 1676E-7 and 15.3 gpt gold over 5.5 m (0.45 oz per ton over 18.0 ft) in hole 1676E-4. Significant intercepts were as follows:

|

Hole |

From |

Length |

Gold |

Length |

Gold |

|

(No.) |

(m) |

(m) |

(gpt) |

(ft) |

(opt) |

|

|

|

|

|

|

|

|

1646E-9 |

378.5 |

1.3 |

20.6 |

4.3 |

0.60 |

|

|

|

|

|

|

|

|

1676E-4 |

231.4 |

4.4 |

9.7 |

14.4 |

0.28 |

|

and |

251.5 |

5.5 |

15.3 |

18.0 |

0.45 |

|

|

|

|

|

|

|

|

1676E-7 |

212.6 |

3.8 |

23.0 |

12.5 |

0.67 |

|

|

|

|

|

|

|

|

240SW-4 |

265.0 |

6.0 |

7.1 |

19.7 |

0.21 |

|

|

|

|

|

|

|

|

240SW-5A |

277.2 |

3.2 |

8.0 |

10.5 |

0.23 |

|

|

|

|

|

|

|

|

240SW-7 |

203.4 |

7.1 |

7.7 |

23.3 |

0.22 |

|

incl. |

209.5 |

1.0 |

13.1 |

3.3 |

0.38 |

|

and |

231.6 |

2.9 |

18.7 |

9.5 |

0.55 |

|

and |

385.2 |

1.0 |

8.6 |

3.3 |

0.25 |

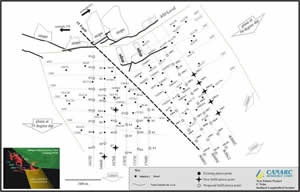

For drill hole locations, refer to the C Veins Longitudinal Section click here. All previous drill holes are shown as solid circles, proposed 2006 hole locations are shown as open circles and the holes reported in this news release are shown as stars. Note that this year’s drill hole numbers refer to location along the section lines, not chronological sequence. Therefore, previous drill holes located along the section lines will cause some gaps to appear in this year’s drill hole number sequence. True widths are estimated to be 70 to 75% of core lengths.

Holes 240SW-3 and 240SW-4.5 both intersected weak gold mineralization below the 5 gpt cut-off grade in the C Vein along the north-eastern most section line in an area where previous drill holes failed to intercept significant mineralization. However, the two deeper holes on the same section line, 240SW-5A and 240SW-7, both intersected strong gold mineralization of good grade. Therefore, the C vein appears to be strengthening at depth on this section line and could open up a whole new area to drill.

Canarc owns a 100% interest (subject to a 10% net profit royalty) in the New Polaris property, a former high-grade, underground gold mine that produced 231,000 oz of gold between 1939 and 1951. From 1990 to 1997, Canarc invested over CA$15 million exploring New Polaris to outline an historic resource of 1.3 million oz gold contained within 3.6 million tons grading 0.36 oz per ton (3.3 million tonnes grading 12.3 gpt) that preceded NI 43-101, and which is not compliant with it and therefore should not be relied upon.

In 2006, Canarc plans to complete 20,000 m (65,000 ft) of infill core drilling in approximately 65 holes on a 30 m (100 ft) grid pattern to depths of 360 m (1,200 ft) using two drill rigs in order to delineate a NI 43-101 compliant, measured, indicated and inferred gold resource of 600,000 to 650,000 oz contained within 1.2 to 1.6 million tons grading 0.4 to 0.5 oz per ton gold (1.1 to 1.5 million tonnes grading 13.7 to 17.2 gpt gold). Results will be released approximately every two weeks from June to September.

After completing a new resource estimate, Canarc plans to refine the conceptual mine plan, complete an initial economic evaluation and enter into the provincial mine development permitting process by year-end. The New Polaris project should then move to a full feasibility study and final permitting in 2007.

James Moors, B.Sc., P.Geo, is the Qualified Person supervising the 2006 drill program on the New Polaris property. He has instituted a Quality Control sampling program of blanks, duplicates and standards to ensure the integrity of all assay results. All drill core is split by Canarc personnel at the New Polaris camp, and then flown to Vancouver for assay by ALS Chemex. The core samples are dried, crushed, split and a 30-gram sub-sample is taken for analysis. Gold content is determined by fire assay with a gravimetric finish on samples containing greater than 1 gpt Au, and other trace elements are analyzed by atomic absorption. ALS Chemex also uses its own standards for quality control checks.

At the Canarc Annual General Meeting held on June 29th, shareholders re-elected the Board of Directors, re-appointed KPMG as auditors and approved amendments to the Company’s stock option plan.

Canarc Resource Corp. is a growth-oriented, gold exploration and mining company listed on the TSX (symbol CCM) and the OTC-BB (symbol CRCUF). The Company’s principal assets are its 100% interest in the New Polaris gold deposit, British Columbia and its 80% option on the Benzdorp gold property in Suriname. Major shareholders include Barrick Gold Corp. and Kinross Gold Corp.

On Behalf of the Board of Directors

CANARC RESOURCE CORP.

/s/ Bradford J. Cooke

Bradford J. Cooke

Chairman and C.E.O.

For more information, please contact Gregg Wilson at Toll Free: 1-877-684-9700, tel: (604) 685-9700, fax: (604) 685-9744, email: invest@canarc.net or visit our website, www.canarc.net. The TSX Exchange has neither approved nor disapproved the contents of this news release.

CAUTIONARY DISCLAIMER – FORWARD LOOKING STATEMENTS

Certain statements contained herein regarding the Company and its operations constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. All statements that are not historical facts, including without limitation statements regarding future estimates, plans, objectives, assumptions or expectations of future performance, are “forward-looking statements”. We caution you that such “forward looking statements” involve known and unknown risks and uncertainties that could cause actual results and future events to differ materially from those anticipated in such statements. Such risks and uncertainties include fluctuations in precious metal prices, unpredictable results of exploration activities, uncertainties inherent in the estimation of mineral reserves and resources, fluctuations in the costs of goods and services, problems associated with exploration and mining operations, changes in legal, social or political conditions in the jurisdictions where the Company operates, lack of appropriate funding and other risk factors, as discussed in the Company’s filings with Canadian and American Securities regulatory agencies. The Company expressly disclaims any obligation to update any forward-looking statements.