Canagold Announces Additional High-Grade Gold Drill Intercepts from the C-10 and the C-West Main Veins at New Polaris Project, BC

Vancouver, Canada – March 21, 2022 – Canagold Resources Ltd. (TSX: CCM, OTC-QB: CRCUF, Frankfurt: CANA) announces high-grade gold assays for five more drill holes from the expanded drill program at its 100% owned New Polaris Gold project located in northwestern British Columbia, 100 kilometers (km) south of Atlin and 60 km northeast of Juneau, Alaska.

The assay results include samples from recently completed drilling of additional intercepts of the C-10 vein (“C-10”) as well as the C-West Main vein (“CWM”):

Highlights:

21-1875E3W1

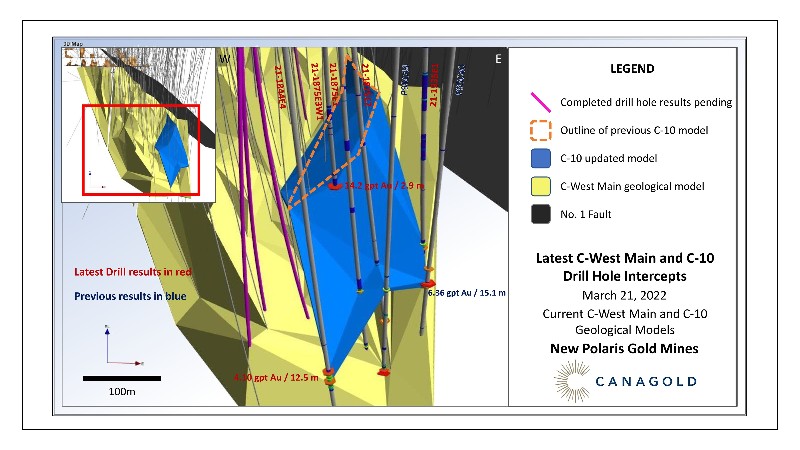

- 14.2 grams per tonne (“gpt”) gold (“Au”) over 2.9 meters (“m”) from 426.8 m (C-10)

- 5.99 gpt Au over 2.1 m from 633.6 m (CWM)

21-1844E4

- 4.10 gpt Au over 12.5 m from 549.3 m (C-10)

- 5.16 gpt Au over 1.9 m from 738.7 m (CWM)

21-1875E1

- 8.61 gpt Au over 2.9 m from 504.1 m (C-10)

- 5.81 gpt Au over 0.7 m from 569.9 m (CWM)

21-1875E2

- 4.62 gpt Au over 0.6 m from 491.1 m (C-10)

- 6.84 gpt Au over 1.5 m from 555.7 m (CWM)

21-1935E1

- 8.10 gpt Au over 1.5 m from 479.0 m (C-10)

- 8.37 gpt Au over 2.8 m from 523.0 m (CWM)

Scott Eldridge, CEO and Director, said, “We continue to receive robust assay results from approximately 30,000 meters of drilling we’ve conducted since May of last year. This most recent batch of results is of particular interest as we’ve now expanded the C-10 vein by 500%. The C-10 does not contain any resources do date, but has delivered robust results consistently, thus increasing our confidence to increase the overall resource size at New Polaris. We still have multiple results pending on the C-10 to potentially see additional continuity at depth.”

Detailed information for the five drill holes including the sample gold assay results and mineralized intercepts with true widths calculated for the CWM are provided in Table 1 and Table 2 below.

These additional intercepts of the C-10 vein have expanded the size of the interpreted C-10 geological model by 500% since the last reported results. Drill holes 21-1875E2 and 21-1935E1 infilled the area to the east and down dip of the previously defined limits to the C-10 allowing for interpolation of the model to include mineralized intercepts from previously drilled holes including:

- 10.0 gpt Au over 5.1 m from 493.8 m in hole P95C40

- 4.15 gpt Au over 1.3 m from 494.3 m in hole P95C44

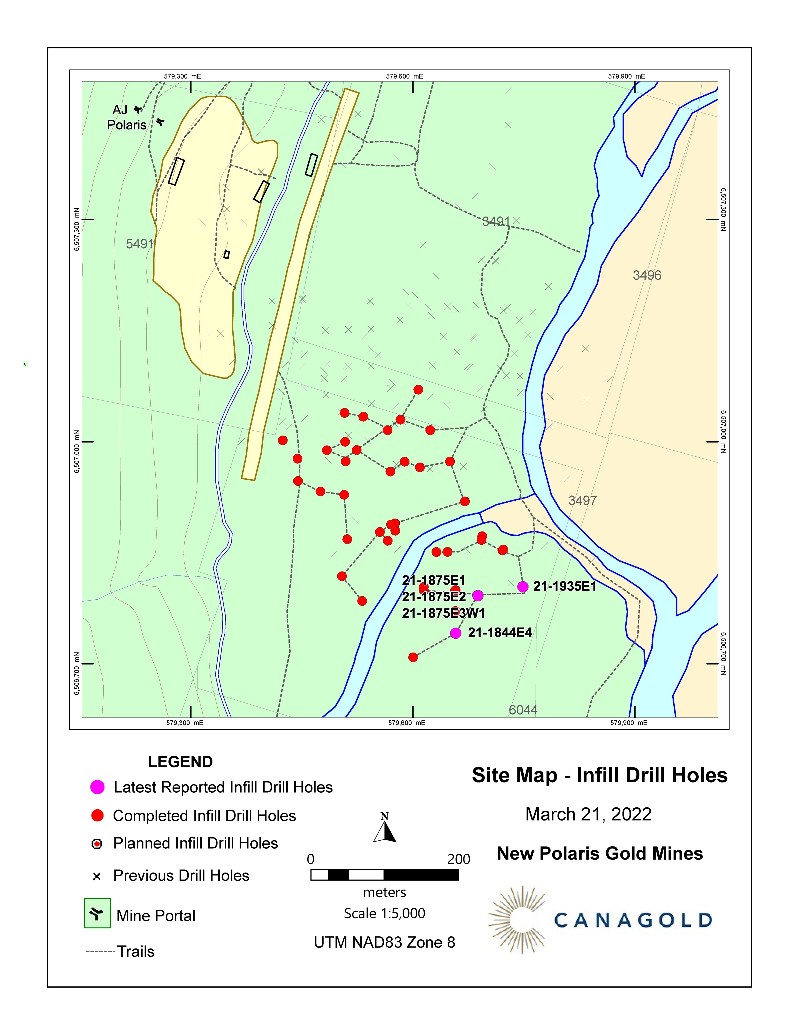

Four more drill holes completed during the program still have results pending that could extend the C-10 vein further.

All of the planned 47-holes of the originally proposed 24,000 m infill drill program were completed by the end of 2021 and assay results have been received for 37 holes. An additional 6,000 meters of drilling in 7 holes were completed in January and February 2022. The samples collected from the mineralized zone in all of those holes have been submitted to the ALS Geochemistry lab in Whitehorse, YT for gold analysis. Results from the remaining holes of the original infill program and those from the extended program will be released as they are received in the coming weeks. Drilling has now been completed for the season prior to the spring thaw, as planned. Drilling equipment is being stored on site ready for the start of the next drilling campaign in the summer of 2022.

Infill Holes to Upgrade Inferred Resources to Indicated Resources

The current drill program is designed primarily to in-fill drill the Inferred Resources of the CWM vein system within the currently defined resources in the PEA*. The infill drill holes range in depth from 300 to 650 m and are designed to provide greater density of drill intercepts (20 – 25 m spacing) in areas of Inferred Resources between 150 and 600 m below surface. The improved drill density will be used to upgrade parts of the Inferred Resources to Indicated Resources for inclusion in a future feasibility study.

*The New Polaris resource is contained within a preliminary economic assessment (“PEA”) report which was prepared by Moose Mountain Technical Services in the format prescribed by NI43-101 Standards of Disclosure for Mineral Projects, and filed on Sedar April 18, 2019.

New Polaris Overview

Canagold’s flagship asset is the 100% owned New Polaris Gold Mine project located in northwestern British Columbia about 100 kilometers south of Atlin, BC and 60 kilometers northeast of Juneau, Alaska. The property consists of 61 contiguous Crown-granted mineral claims and one modified grid claim covering 850 hectares. New Polaris lies within the Taku River Tlingit First Nations traditional territory. Canagold is committed to providing employment and business opportunities that help support the local economies in the vicinity of its exploration projects.

The New Polaris gold deposit is an early Tertiary, mesothermal gold-bearing vein system occupying shear zones cross-cutting late Paleozoic andesitic volcanic rocks. It was mined by underground methods from 1938 to 1942, and again from 1946 to early 1951, producing approximately 245,000 oz gold from 740,000 tonnes of ore at an average grade of 10.3 gpt gold. Three main veins (“AB, C and Y”) were mined to a maximum depth of 150 m and have been traced by drilling for up to 1,000 m along strike and up to 800 m down dip, still open for expansion. The gold occurs dominantly in finely disseminated arsenopyrite within quartz-carbonate stock-work veins and altered wall-rocks. Individual mineralized zones extend up to 250 meters in length and 14 meters in width. Average widths more commonly range from 2 to 5 meters.

Director Resignation

The Company also announces that Andrew Bowering has resigned from the Board of Directors in order to focus on his own companies. The Board and management team would like to take this opportunity to thank him for his valuable contributions since joining.

Qualified Person

Garry Biles, P.Eng, President & COO for Canagold Resources Ltd, is the Qualified Person who reviewed and approved the contents of this news release.

Drill Core Sampling and Quality Assurance – Quality Control Program

Drill core is geologically logged to identify the gold mineralized zones that are allocated unique sample number tickets and marked for cutting using a purpose-built diamond blade rock saw. Half core samples are collected in labelled bags and the other half remains in the original core box stored on site. Quality control (QC) samples including certified reference material standards, blanks and duplicates are inserted into the sample sequence at intervals of one in ten on a rotating basis to monitor laboratory performance and provide quality assurance (QA) of the assay results. Several sample bags are transported together in rice bags with unique numbered security tags attached and labelled with Company and lab contact information to ensure sample security and chain of custody during shipment to the lab.

The samples are submitted to the ALS Geochemistry lab in Whitehorse, YT for preparation and assaying. The entire sample is crushed to 70% passing -2 millimeters and a 250 gram aliquot is split and pulverized to 85% passing -75 microns. Analysis for gold is by 30 gram fire assay and gravimetric finish. A suite of 30 other elements including arsenic, antimony, sulfur and iron are analyzed by aqua-regia digestion Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES). ALS Canada Ltd. is accredited by the Standards Council of Canada and is an ISO/IEC 9001:2015 and 17025:2017 certified analytical laboratory in North America.

"Scott Eldridge”

____________________

Scott Eldridge, Chief Executive Officer

CANAGOLD RESOURCES LTD.

About Canagold - Canagold Resources Ltd. is a growth-oriented gold exploration company focused on generating superior shareholder returns by discovering, exploring and developing strategic gold deposits in North America. Canagold shares trade on the TSX: CCM and the OTCQB: CRCUF.

For More Information - Please contact: Knox Henderson, VP Corporate Development

Toll Free: 1-877-684-9700 Tel: (604) 604-416-0337 Cell: (604) 551-2360

Email: knox@canagoldresources.com Website: www.canagoldresources.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Statements contained in this news release that are not historical facts are forward-looking information that involves known and unknown risks and uncertainties. Forward-looking statements in this news release include, but are not limited to, statements with respect to the future performance of Canagold, and the Company's plans and exploration programs for its mineral properties, including the timing of such plans and programs. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "has proven", "expects" or "does not expect", "is expected", "potential", "appears", "budget", "scheduled", "estimates", "forecasts", "at least", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others risks related to the uncertainties inherent in the estimation of mineral resources; commodity prices; changes in general economic conditions; market sentiment; currency exchange rates; the Company's ability to continue as a going concern; the Company's ability to raise funds through equity financings; risks inherent in mineral exploration; risks related to operations in foreign countries; future prices of metals; failure of equipment or processes to operate as anticipated; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals; government regulation of mining operations; environmental risks; title disputes or claims; limitations on insurance coverage and the timing and possible outcome of litigation. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, do not place undue reliance on forward-looking statements. All statements are made as of the date of this news release and the Company is under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

Table 1: Drill Hole Collar Information

| Hole ID | Mine East | Mine North | Elevation | Dip | Azimuth | Final Depth |

| 21-1844E4 | 1844.00 | 460.00 | 19.6 | -78 | 344 | 836 |

| 21-1875E1 | 1875.00 | 510.00 | 19.7 | -78 | 348 | 590 |

| 21-1875E2 | 1874.70 | 511.45 | 19.7 | -76 | 348 | 593 |

| 21-1875E3W1 | 1874.06 | 514.40 | 19.7 | -76 | 346 | 731 |

| 21-1935E1 | 1935.95 | 520.70 | 19.7 | -78 | 348 | 572 |

Table 2: Drill Core Sample Results Details

| Hole ID | From (m) | To (m) |

Length (m) [True Width] |

Au (gpt) |

| 21-1844E4 | 549.3 | 550.3 | 1.0 | 13.3 |

| 21-1844E4 | 550.3 | 550.9 | 0.6 | 0.025 |

| 21-1844E4 | 550.9 | 551.5 | 0.6 | 5.61 |

| 21-1844E4 | 551.5 | 552.7 | 1.2 | 2.71 |

| 21-1844E4 | 552.7 | 553.6 | 0.9 | 0.025 |

| 21-1844E4 | 553.6 | 554.6 | 1.0 | 3.58 |

| 21-1844E4 | 554.6 | 555.6 | 1.0 | 2.23 |

| 21-1844E4 | 555.6 | 556.5 | 0.9 | 0.025 |

| 21-1844E4 | 556.5 | 557.6 | 1.1 | 3.78 |

| 21-1844E4 | 557.6 | 558.6 | 1.0 | 0.91 |

| 21-1844E4 | 558.6 | 559.4 | 0.8 | 0.82 |

| 21-1844E4 | 559.4 | 560.6 | 1.2 | 12.6 |

| 21-1844E4 | 560.6 | 561.7 | 1.1 | 4.53 |

| 21-1844E4 | 549.3 | 561.7 | 12.5 | 4.10 |

| 21-1844E4 | 738.7 | 739.7 | 1.0 | 5.54 |

| 21-1844E4 | 739.7 | 740.6 | 0.9 | 4.79 |

| 21-1844E4 | 738.7 | 740.6 | 1.9 [1.3] | 5.16 |

| 21-1844E4 | 788.8 | 789.6 | 0.7 | 11.4 |

| 21-1844E4 | 789.6 | 790.6 | 1.0 | 0.5 |

| 21-1844E4 | 790.6 | 791.2 | 0.6 | 6.01 |

| 21-1844E4 | 788.9 | 791.2 | 2.3 | 5.48 |

| 21-1875E1 | 504.1 | 506 | 1.9 | 8.35 |

| 21-1875E1 | 506.0 | 507.0 | 1.0 | 9.08 |

| 21-1875E1 | 504.1 | 507.0 | 2.9 | 8.61 |

| 21-1875E1 | 569.9 | 570.6 | 0.7 [0.5] | 5.81 |

| 21-1875E2 | 193.6 | 194.6 | 1.0 | 6.00 |

| 21-1875E2 | 194.6 | 195.4 | 0.8 | 11.2 |

| 21-1875E2 | 195.4 | 195.8 | 0.4 | 14.1 |

| 21-1875E2 | 195.8 | 196.1 | 0.3 | 3.08 |

| 21-1875E2 | 193.6 | 196.1 | 2.5 | 8.37 |

| 21-1875E2 | 491.1 | 491.7 | 0.6 | 4.62 |

| 21-1875E2 | 555.7 | 556.2 | 0.5 | 6.16 |

| 21-1875E2 | 556.2 | 556.6 | 0.4 | 13.1 |

| 21-1875E2 | 556.6 | 557.2 | 0.6 | 2.85 |

| 21-1875E2 | 555.7 | 557.2 | 1.5 [1.1] | 6.84 |

| 21-1875E3W1 | 426.8 | 427.2 | 0.4 | 1.13 |

| 21-1875E3W1 | 427.2 | 427.7 | 0.5 | 21.7 |

| 21-1875E3W1 | 427.7 | 428.7 | 1.0 | 18.4 |

| 21-1875E3W1 | 428.7 | 429.7 | 1.0 | 10.6 |

| 21-1875E3W1 | 426.8 | 429.7 | 2.9 | 14.2 |

| 21-1875E3W1 | 633.5 | 634.3 | 0.8 | 10.4 |

| 21-1875E3W1 | 634.3 | 634.7 | 0.4 | 7.44 |

| 21-1875E3W1 | 634.7 | 635.6 | 0.9 | 1.67 |

| 21-1875E3W1 | 633.6 | 635.6 | 2.1 [1.6] | 5.99 |

| 21-1935E1 | 479.0 | 479.7 | 0.7 | 11.2 |

| 21-1935E1 | 479.7 | 480.5 | 0.8 | 5.10 |

| 21-1935E1 | 479.0 | 480.5 | 1.5 | 8.10 |

| 21-1935E1 | 523.0 | 524.4 | 1.4 | 5.91 |

| 21-1935E1 | 524.4 | 525.8 | 1.4 | 10.9 |

| 21-1935E1 | 523.0 | 525.8 | 2.8 [2.1] | 8.37 |

Based on the current spacing of the drill hole intercepts the exact attitude of the C-10 vein remains open to interpretation, so the true widths have not been calculated at this time. Composites were calculated from length weighted Au sample interval results. Grade capping and cut-off have not been applied.