Canagold Increases Indicated Gold Resource by 89% in Updated Mineral Resource Estimate for New Polaris Gold Project, BC

Vancouver, B.C. – May 16, 2023 - Canagold Resources Ltd. (TSX: CCM, OTC-QB: CRCUF, Frankfurt: CANA) (“Canagold” or the “Company”) is pleased to announce the Updated Mineral Resource Estimate for New Polaris Gold Project located approximately 100 kilometres south of Atlin, BC.

Underground Mineral Resource Estimate (MRE): 2.97 million tonnes (Mt)@ 11.6 grams per tonne gold (gpt Au) for 1.11 million ounces (Moz) contained gold Indicated and 0.93 Mt @ 8.93 gpt Au for 0.27 Moz contained gold Inferred.

Highlights:

- 89% increase in the Indicated category contained ounces of gold compared to the 2019 preliminary economic assessment (“PEA”) resource due to a very successful 2021-22 infill drill program.

- 23% Increase to the overall resource tonnage due to the additional veins defined by the 2021-22 infill drilling that were integrated into the new geological model.

- Gold grade improvement by 8% in the Indicated category to 11.61 gpt Au, up from 10.8 gpt Au in the 2019 PEA due to the refined geological model constrained by the additional drilling.

- The updated 2023 MRE provides the Indicated category resource required to underpin the Feasibility Study announced on October 11, 2022.

“Canagold’s 2021-22 exploration program has proved highly successful in reaching our primary objective of adding more gold ounces into the Indicated category,” said Catalin Kilofliski, CEO of Canagold Resources. “The Company’s goal has been to hit our target of more than one million ounces to feed into the feasibility study currently underway with Ausenco Engineering. Right now, we’re working with a potential mine plan that targets 100,000 ounces per year based on an approximately 10-year mine life and assuming the current drilling depth we’ve achieved to date.”

The updated 2023 MRE reflects the Company’s success in completing an additional 40,000 meters (“m”) of infill drilling, targeting areas of previously inferred category resource from the 2019 PEA. The refined geological model now includes 17 vein domains of at least 2 metre width. A grade shell was applied to the block model and any outlying mineralized volumes too small to be considered to have “reasonable prospects for eventual economic extraction” were discarded to create the resource at each Au cutoff grade. A base case cutoff grade of 4 gpt Au was selected which covers the preliminary mining, processing and G&A costs at the base case Au price, and using the inputs as summarized in the Notes to the resource table, below.

| New Polaris - Resource Estimate, effective date: April 20, 2023 and Comparison to 2019 PEA | ||||||||||

| 2023 Resource | 2019 Resource | Difference as a Percent: | ||||||||

| Class | Cutoff | Tonnage (ktonnes) | Au (gpt) | Au (koz) | Tonnage (ktonnes) | Au (gpt) | Au (koz) | (2023-2019)/2019 | ||

| (Au gpt) | Tonnage | Au Grade | Au Metal | |||||||

| Indicated | 3 | 3,118 | 11.21 | 1,124 | 1,798 | 10.40 | 601 | 73% | 8% | 87% |

| 4 | 2,965 | 11.61 | 1,107 | 1,687 | 10.80 | 586 | 76% | 8% | 89% | |

| 5 | 2,769 | 12.11 | 1,078 | 1,556 | 11.30 | 565 | 78% | 7% | 91% | |

| 6 | 2,525 | 12.75 | 1,035 | 1,403 | 12.00 | 541 | 80% | 6% | 91% | |

| 7 | 2,270 | 13.45 | 981 | 1,260 | 12.60 | 510 | 80% | 7% | 92% | |

| 8 | 2,049 | 14.09 | 928 | 1,105 | 13.30 | 473 | 85% | 6% | 96% | |

| 9 | 1,814 | 14.81 | 864 | 947 | 14.10 | 429 | 92% | 5% | 101% | |

| 10 | 1,594 | 15.55 | 797 | 1,639 | 9.50 | 501 | -3% | 64% | 59% | |

| Inferred | 3 | 1,061 | 8.24 | 281 | 1,582 | 9.80 | 498 | -33% | -16% | -44% |

| 4 | 926 | 8.93 | 266 | 1,483 | 10.20 | 486 | -38% | -12% | -45% | |

| 5 | 817 | 9.52 | 250 | 1,351 | 10.70 | 465 | -40% | -11% | -46% | |

| 6 | 706 | 10.16 | 231 | 1,223 | 11.20 | 440 | -42% | -9% | -48% | |

| 7 | 603 | 10.78 | 209 | 942 | 12.50 | 379 | -36% | -14% | -45% | |

| 8 | 491 | 11.52 | 182 | 753 | 13.80 | 334 | -35% | -17% | -46% | |

| 9 | 371 | 12.51 | 149 | 653 | 14.60 | 307 | -43% | -14% | -51% | |

| 10 | 291 | 13.33 | 125 | 0 | 0.00 | 0 | ||||

Notes to the Resource Table:

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves.

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines.

- The base case Mineral Resource has been confined by "reasonable prospects of eventual economic extraction" shape using the following assumptions:

- Metal prices of US$1,750/oz Au and Forex of 0.75 $US:$CDN;

- Payable metal of 99% Au;

- Offsite costs (refining, transport and insurance) of US$7/oz;

- Mining cost of CDN$82.78/t , Processing costs of CDN$105.00/t and G&A and site costs of CDN$66.00/t.

- Metallurgical Au recovery of 90.5%;

- NSR (CDN$/t)=Au*90.5%*US$74.72g/t;

- The specific gravity is 2.81 for the entire deposit;

- Numbers may not add due to rounding.

About the Mineral Resource Estimate

- A comprehensive statistical review of all available QA/QC assay data from the drilling was undertaken as part of the 2023 MRE.

- Interpolation was by inverse distance squared (“ID2”), which is a change from Ordinary kriging used in the 2019 PEA. However, variograms were created on a global basis to aid in determination of Classification parameters.

- Gold values were capped for each individual domain of the geological model based on statistical probability plots.

- The 2023 MRE is based on a 5 m block model using a Percentage Model (meaning that the percentage of the block within the domain is used for the MRE).

- A constant specific gravity of 2.81 g/cc is used for all blocks in the model, based on an average of measured sample SG’s.

- Indicated classification of a block required either 1) average distance to two drill holes of 35 m, maximum distance 50 m and minimum number of two quadrants, or 2) average distance to two drill holes of 50 m, maximum distance 70 m and minimum number of two quadrants, or 3) distance to closest drill hole of 10 m, maximum distance of 50 m used and minimum number of three drill holes used.

- The classification was checked for cohesiveness, with a cohesive shape of Indicated and Inferred material produced.

- The base case cutoff grade of 4 gpt Au is based on a US$1,750/ounce price of gold and preliminary recovery, processing and mining costs which are based on preliminary production rate values as summarized in the Notes to the resource table.

- The 2023 MRE table presents undiluted values of gold grade and contained gold ounces.

- The following factors, among others, could affect the 2023 MRE: assumptions used in generating confining shapes, stope design; mining methods; metal recoveries, mining and process cost assumptions and commodity price and exchange rate assumptions. The QP is not aware of any environmental, permitting, legal, title, taxation, socioeconomic, marketing, political, or other relevant factors that could materially affect the 2023 MRE.

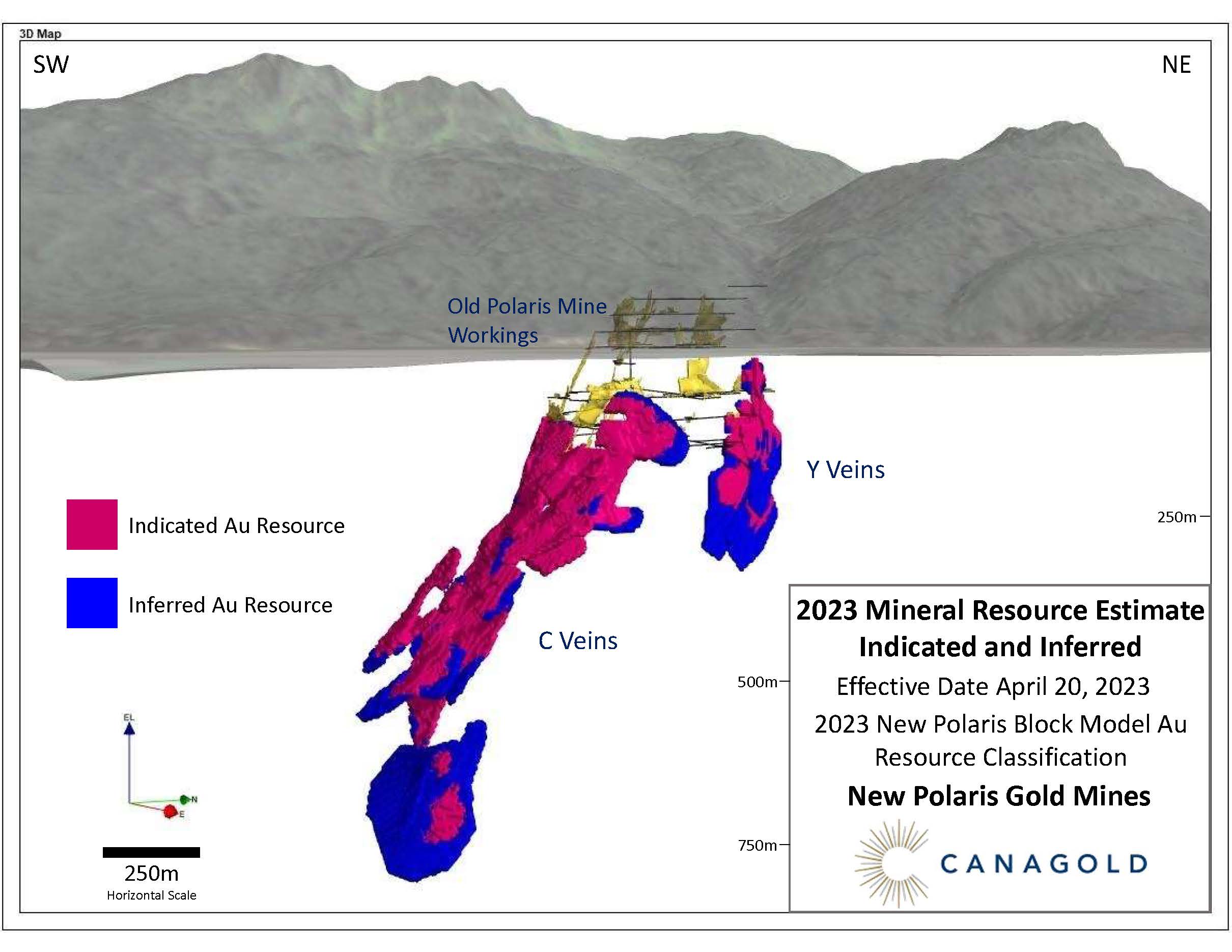

The figure below illustrates a three-dimensional view of the previous underground workings, and the modelled vein shapes with the blocks illustrating the classification.

Figure 1: Classification of the Polaris Resource

About New Polaris

New Polaris is Canagold’s flagship asset, which is the 100% owned gold mine project located in northwestern B.C. about 100 kilometres south of Atlin, B.C. and 60 kilometres northeast of Juneau, Alaska. The property consists of 61 contiguous Crown-granted mineral claims and one modified grid claim covering 850 hectares. New Polaris lies within the Taku River Tlingit First Nation (“TRTFN”) traditional territory. Canagold is firmly committed to working closely with the TRFTN on all aspects of project’s, consultations, planning and future development plans. The Company’s primary objective is to build a successful long-term partnership with TRTFN, in order to plan and create together a project with a long-lasting positive impact on the environment, the members of the TRTFN, the local community of Atlin and other surrounding communities.

Feasibility Study

The updated Mineral Resource Estimate will be integrated into the New Polaris Feasibility Study (“FS”) that commenced in 2022 and that the Company continues to advance over the course of 2023.

The FS is a definitive study building on the 2019 Preliminary Economic Assessment (“PEA”) that demonstrated reasonable prospects for eventual economic extraction of the New Polaris Project. Using a gold price of US $1,500 per oz, the PEA indicated cash costs of US$400 per oz, an after-tax Net Present Value (NPV with 5% discount) of CA$469 million with an after-tax Internal Rate of Return (IRR) of 56% and a 1.9 year pay-back period.

The PEA proposed an underground mine with a 750 tonnes per day (tpd) process plant that would operate year-round, producing approximately 80 koz of doré gold annually at full production. The project site would include an on-site camp and airstrip, as well as a downstream barge landing site. Major bulk supplies for mining and processing would be barged along the Taku River to the barge landing site between May and September. Minor supplies and personnel would be flown to and from the mine site via small aircraft or helicopter.

Backed by the positive results of the updated Mineral Resource Estimate, the Company is evaluating the prospect of increased annual gold production, potentially increasing the throughput design basis underlying the FS.

The FS is supported by Ausenco Engineering Canada Inc. (“Ausenco”) who have been retained to provide basic engineering and study services for surface infrastructure and the process plant, freight logistics and environmental baseline work. AMC Mining Consultants (Canada) Ltd. (“AMC”) have been retained to provide all study requirements associated with mining. The Company expects to conclude the FS during 2024.

Qualified Person

The 2023 MRE was prepared by Sue Bird, M Sc., P.Eng. V.P. of Resources and Engineering at Moose Mountain Technical Services, an independent Qualified Person as defined by NI 43-101. Sue has also reviewed and approved the technical information about the 2023 MRE contained in this news release.

Garry Biles, P.Eng, President & COO for Canagold Resources Ltd, is the Qualified Person who reviewed and approved the contents of this news release.

About Canagold

Canagold Resources Ltd. is a growth-oriented gold exploration company focused on advancing the New Polaris Project through feasibility and permitting. Canagold is also seeking to grow its assets base through future acquisitions of additional advanced projects. The Company has access to a team of technical experts that can help unlock significant value for all Canagold shareholders.

“Catalin Kilofliski”

Catalin Kilofliski

Chief Executive Officer

For further information please contact:

Knox Henderson, VP Corporate Development

Tel: (604) 604-416-0337; Cell: (604) 551-2360

Toll Free: 1-877-684-9700

Email: knox@canagoldresources.com

Website: www.canagoldresources.com

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Statements contained in this news release that are not historical facts are forward-looking information that involves known and unknown risks and uncertainties. Forward-looking statements in this news release include, but are not limited to, statements with respect to the future performance of Canagold, and the Company's plans and exploration programs for its mineral properties, including the timing of such plans and programs. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "has proven", "expects" or "does not expect", "is expected", "potential", "appears", "budget", "scheduled", "estimates", "forecasts", "at least", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others risks related to the uncertainties inherent in the estimation of mineral resources; commodity prices; changes in general economic conditions; market sentiment; currency exchange rates; the Company's ability to continue as a going concern; the Company's ability to raise funds through equity financings; risks inherent in mineral exploration; risks related to operations in foreign countries; future prices of metals; failure of equipment or processes to operate as anticipated; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals; government regulation of mining operations; environmental risks; title disputes or claims; limitations on insurance coverage and the timing and possible outcome of litigation. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, do not place undue reliance on forward-looking statements. All statements are made as of the date of this news release and the Company is under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.