Canarc Reports NI 43-101 Resource Estimate For the Fondaway Canyon Property, Nevada, USA

Vancouver, Canada -11 April 2017 - Canarc Resource Corp. (TSX: CCM, OTC-BB: CRCUF, Frankfurt: CAN) announces that it has received an updated, independent, resource estimate for the Fondaway Canyon property located in Churchill County, Nevada, USA. A technical report (“technical report”) documenting the new resource estimate will be filed on SEDAR within 45 days in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Fondaway Canyon is an advanced stage gold exploration property located in Churchill County, Nevada, USA, part of an 11-property package acquired by Canarc in March 2017. The property includes 136 unpatented claims covering 900 hectares, and has a history of previous surface exploration and open pit gold mining in the late 1980’s and early 1990’s.

Canarc commissioned Techbase International of Reno, Nevada to complete a technical Report for the Fondaway Canyon Project. The updated resource estimate included in the technical report is shown in the table below.

| Resource Category |

Tonnes1 (t) |

Grade (g/t) Au |

Ounces2 (oz) Au |

Type |

| Indicated | 2,050,000 | 6.18 | 409,000 | UG/Sulfide |

| Inferred | 3,200,000 | 6.40 | 660,000 | UG/Sulfide |

| 1 Resource based on cut-off of 1.8m horizontal width >= 3.43 g/t 2 Rounding differences may occur |

||||

- CIM Definition Standards were followed for reporting the Mineral Resource estimates

- Mineral Resources are reported on a dry, in-situ basis. A bulk density of 2.56 tonnes/m3 was applied for volume to tonnes conversion.

- The reporting cutoff grade of 3.43 g/t was based on capital and operating costs for a similar project, the three-year trailing average Au price of $US 1,225/ oz Au , a metallurgical recovery of 90%, and an underground mining method suitable for steeply-dipping veins.

- Mineral Resources are estimated from surface to approximately 400 m depth.

- The quantity and grade of Inferred Resources in this estimate are uncertain in nature, there has been insufficient exploration to define these Inferred Resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category. Environmental, geotechnical, permitting, legal, title, taxation, socio‐political, marketing or other relevant issues could materially affect the mineral resource estimate.

The Resource Estimate was prepared by Michael Norred, SME Registered Member 2384950; President of Techbase International, Ltd (Techbase) of Reno, Nevada and Simon Henderson, MSc, MAusIMM CP 110883 (Geology); Consulting Geologist with Wairaka Rock Services Limited of Wellington, New Zealand, both Qualified Persons (QPs), as defined by NI 43-101.

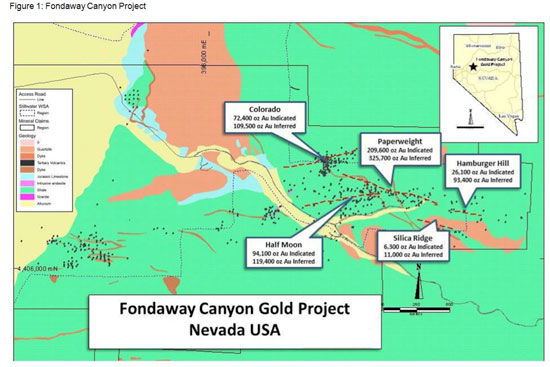

The Fondaway Canyon mineralization is contained in a series of 12 steeply dipping, en-echelon quartz-sulfide vein-shear zones outcropping at surface and extending laterally over 1200m and vertically to depths of > 400m. The Paperweight, Half-moon and Colorado zones host the bulk of the resources, with the remainder in parallel veins or splays of the major vein-shears.

A total of 591 historic drill holes were validated for resource estimation, with coordinate information and down hole assays. These included 8411m of core drilling in 49 holes and 40,675m of RC drilling in 551 holes. Drill core was inspected at the Fallon, NV storage facility and assay certificates were viewed to verify gold intercept grades used in the estimate.

Check assays were run systematically on approximately 5% of the total assays, including 23% of assays greater than 3.43 g/t. Duplicate assays were run on slightly less than 1% of the total assays, including 14% of assays greater than 3.43 g/t. Consistency was good for the check assays and duplicates, with correlations greater than 98% in each case.

A Mineral Resource was estimated for each vein using polygonal estimation on drill intercepts projected onto a vertical long-section parallel to the average strike direction of that vein. The polygons were truncated at faults that were interpreted to limit the extent of the mineralization.

The Mineral Resources are reported at a cut-off of 3.43 g/t, over a minimum horizontal width of 1.8m, based on projects of similar size, a gold price of $US 1,225 per oz, a metallurgical recovery of 90%, and an underground mining method suitable for steeply-dipping veins. A processing method has not yet been selected.

Metallurgical testing showed that acceptable recoveries could be obtained from the sulfide material by using an oxidizing pre-treatment, followed by CIL leaching, with recoveries up to 86 to 95%. Further metallurgical testing and design work will be needed in order to design the most cost-effective method

No capping or cutting of grades was applied. The assayed grades were found to be very consistent when compared to check assays and duplicates, as well as between twinned holes. The consistency in assay results was interpreted as being due to the very fine-grained nature of the gold mineralization (1 to 10 µm). This consistency provided confidence that the higher-grade assays were reasonable.

Figure 1 shows the location by zone of the Fondaway Canyon resources.

The current Mineral Resource estimate relates only to the eastern half of the 4000m east-west striking mineralized system, and does not include any estimates for near-surface, oxide mineralization. Significant exploration potential remains both in the eastern section, and relatively untested western zone.

Multiple exploration targets have been identified along favorable structural extensions that have potential to host additional significant gold resources. A 30-hole drill program, estimated to cost $2.0 million, has been recommended by Techbase International to explore these identified targets as well upgrade more of the resources into the indicated category.

During April, with the support of two very experienced Nevada based geologists, Canarc will initiate a comprehensive review of all of its newly acquired Nevada properties to evaluate the potential of and prioritize exploration plans for each property.

Mr. Catalin Chiloflischi, CEO of Canarc, stated: “The confirmation of previous resource estimates for the Fondaway Canyon project marks another important step forward for Canarc towards expanding our gold resource base. During 2017, Canarc is planning to allocate additional resources in order to further advance its Nevada projects. We are very excited about Canarc’s new focus and oportunities in Nevada.”

Qualified Persons:

- Michael Norred, SME Registered Member 2384950; President of Techbase International, Ltd (Techbase) of Reno, Nevada is a “Qualified Person” as defined by NI 43-101, has reviewed and approved the technical and scientific information on the Fondaway Canyon Project contained in this release. Michael Norred is independent of Canarc.

- Simon Henderson, MSc, MAusIMM CP 110883 (Geology); Consulting Geologist with Wairaka Rock Services Limited of Wellington, New Zealand both Qualified Persons (QPs), as defined by NI 43-101 has reviewed and approved the technical and scientific information on the Fondaway Canyon Project contained in this release. Simon Henderson is independent of Canarc.

- Garry Biles, P. Eng, President & COO for Canarc Resource Corp, is the Qualified Person who reviewed and approved the contents of this news release. Garry Biles is not independent of Canarc by the nature of his position with the company.

Catalin Chiloflischi”

____________________

Catalin Chiloflischi, CEO

CANARC RESOURCE CORP.

About Canarc Resource Corp. - Canarc is a growth-oriented, gold exploration and mining Company listed on the TSX (CCM) and the OTC-BB (CRCUF). The Company is currently focused on acquiring operating or pre-production stage gold-silver-copper mines or properties in the Americas and further advancing its gold properties in Nevada and BC.

For More Information - Please contact:

Catalin Chiloflischi, CEO

Toll Free: 1-877-684-9700

Tel: (604) 685-9700

Fax: (604) 685-9744

Email: catalin@canarc.net

Website: www.canarc.net

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Statements contained in this news release that are not historic facts are forward-looking information that involves known and unknown risks and uncertainties. Forward-looking statements in this news release include, but are not limited to, statements with respect to the planned completion of the Acquisition, potential strategic M&A transactions being contemplated by Canarc, the future performance of Canarc, and the Company's plans and exploration programs for its mineral properties, including the timing of such plans and programs. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "has proven", "expects" or "does not expect", "is expected", "potential", "appears", "budget", "scheduled", "estimates", "forecasts", "at least", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, the Company’s ongoing due diligence review in relation to the Acquisition, risks related to the uncertainties inherent in the estimation of mineral resources; commodity prices; changes in general economic conditions; market sentiment; currency exchange rates; the Company's ability to continue as a going concern; the Company's ability to raise funds through equity financings; risks inherent in mineral exploration; risks related to operations in foreign countries; future prices of metals; failure of equipment or processes to operate as anticipated; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals; government regulation of mining operations; environmental risks; title disputes or claims; limitations on insurance coverage and the timing and possible outcome of litigation. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, do not place undue reliance on forward-looking statements. All statements are made as of the date of this news release and the Company is under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.