Deepest Drill Hole of 2006 Drilling Program at New Polaris Intersects 7.1 gpt Gold Over 10.2 m Length; 2006 Drill Program Now Complete, Independent N.I. 43-101 Resource Estimate Now Underway

December 12, 2006

December 12, 2006 - Vancouver, Canada - Canarc Resource Corp. (CCM: TSX and CRCUF: OTC-BB) announces that the deepest drill hole of the 2006 drilling program at the New Polaris gold property in northwestern BC, has intersected 7.1 gpt gold over a 10.2 m length. (0.21 opt gold over 33.5 ft) at an approximate depth of 500 m (1600 ft) below surface.

The 2006 drill program has now been successfully completed with the 24,394 m of drilling in 69 diamond drill holes into the C vein system. The final drilling highlights are shown in the following table:

|

Hole |

From |

Length |

Gold |

Length |

Gold |

|

(No.) |

(m) |

(m) |

(gpt) |

(ft) |

(opt) |

|

|

|

|

|

|

|

|

1707DE-1 |

425.6 |

4.5 |

11.8 |

14.8 |

0.34 |

|

incl. |

425.6 |

1.0 |

19.0 |

3.3 |

0.55 |

|

|

|

|

|

|

|

|

1768DE-1 |

473.3 |

0.7 |

12.6 |

2.3 |

0.37 |

|

and |

487.4 |

4.5 |

9.5 |

14.8 |

0.28 |

|

|

|

|

|

|

|

|

1768DE-2 |

538.4 |

10.2 |

7.1 |

33.5 |

0.21 |

|

incl. |

538.4 |

6.2 |

8.9 |

20.3 |

0.26 |

|

incl. |

539.4 |

0.8 |

15.5 |

2.6 |

0.45 |

|

|

|

|

|

|

|

|

1859E-2 |

297.5 |

1.6 |

14.9 |

5.2 |

0.43 |

|

and |

336.2 |

2.1 |

15.6 |

6.9 |

0.46 |

|

incl. |

336.2 |

0.8 |

25.5 |

2.6 |

0.74 |

|

and |

417.4 |

3.4 |

11.0 |

11.2 |

0.32 |

|

incl. |

417.4 |

0.7 |

27.4 |

2.3 |

0.80 |

True widths are approximately 70% to 90% of core lengths.

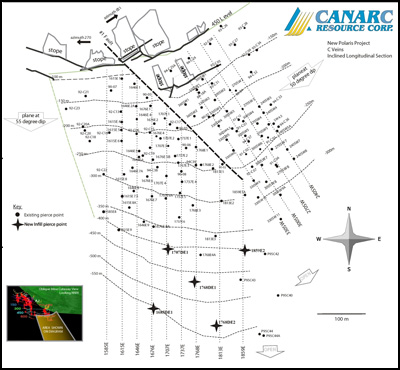

For drill hole locations, refer to the C Veins Longitudinal Section on Canarc’s website New Polaris Project. All previous drill holes are shown as solid circles and the holes reported in this news release are shown as stars. Note that this year’s drill hole numbers refer to location along the section lines, not chronological sequence. Therefore, previous drill holes located along the section lines will cause some gaps to appear in this year’s drill hole number sequence.

Like most of the previously released drill holes of the 2006 drilling program, these most recent holes were drilled to infill the C vein drill grid at approximately 30 m centres. However, the deepest holes, including 1768DE-2 were drilled up to 140 metres below the C vein drill grid in order to prove continuity of the C vein system to depth.

Six deep drill holes were drilled in 1995 to test the C vein system at depth. Five holes intersected high grade gold mineralisation between the elevations of 570 m and 700 m below sea level (b.s.l.) (see table below), however, the bottom of the C vein drill grid in 1995 was at only 250 b.s.l., leaving a large un-drilled gap between the -250 m and -570 m elevations.

Hole 1768DE2 and other deep holes of the 2006 drilling have now demonstrated the continuity of the C vein to a minimum depth of 500 metres b.s.l., while the deeper footwall zone outlined by two drill-holes in 1995 at 700 m b.s.l. remains untested and is open for expansion.

|

Hole |

From |

Length |

Gold |

Length |

Gold |

|

(No.) |

(m) |

(m) |

(gpt) |

(ft) |

(opt) |

|

|

|

|

|

|

|

|

P95C40 |

493.0 |

5.9 |

8.5 |

19.4 |

0.25 |

|

|

727.8 |

7.5 |

11.3 |

24.5 |

0.33 |

|

|

|

|

|

|

|

|

P95C42 |

318.5 |

3.8 |

13.7 |

12.5 |

0.40 |

|

|

351.7 |

2.0 |

4.2 |

6.6 |

0.12 |

|

|

456.5 |

1.1 |

13.1 |

3.6 |

0.38 |

|

|

|

|

|

|

|

|

P95C43 |

338.3 |

2.0 |

6.0 |

6.7 |

0.17 |

|

|

354.5 |

2.5 |

15.1 |

8.2 |

0.44 |

|

|

482.0 |

2.5 |

15.9 |

8.1 |

0.46 |

|

|

|

|

|

|

|

|

P95C44 |

586.5 |

3.1 |

18.8 |

10.1 |

0.55 |

|

|

640.1 |

1.6 |

12.4 |

5.3 |

0.36 |

|

|

692.4 |

1.8 |

28.1 |

5.8 |

0.82 |

|

|

|

|

|

|

|

|

P95C44A |

586.4 |

4.8 |

16.0 |

15.7 |

0.47 |

|

|

726.4 |

4.2 |

6.0 |

13.7 |

0.18 |

An independent N.I. 43-101 resource estimate is now underway, focusing on the C vein system at New Polaris. It will cover many, but not all, of the resource areas estimated historically by Beacon Hill (1988) and Giroux (1995). The resource study is scheduled for completion and release in January 2007.

James Moors, B.Sc., P.Geo, Vice President, Exploration, is the Qualified Person supervising the 2006 drill program on the New Polaris property. He has instituted a Quality Control sampling program of blanks, duplicates and standards to ensure the integrity of all assay results. All drill core is split by Canarc personnel at the New Polaris camp, and then flown to Vancouver for assay by ALS Chemex. The core samples are dried, crushed, split and a 30-gram sub-sample is taken for analysis. Gold content is determined by fire assay with a gravimetric finish on samples containing greater than 1 gpt Au, and other trace elements are analyzed by atomic absorption. ALS Chemex also uses its own standards for quality control checks.

Canarc Resource Corp. is a growth-oriented, gold exploration company listed on the TSX (symbol CCM) and the OTC-BB (symbol CRCUF). The Company’s principal asset is its 100% interest in the New Polaris gold deposit, British Columbia, Canada.

CANARC RESOURCE CORP.

Per:

/s/ Bradford J. Cooke

Bradford J. Cooke

Chairman and C.E.O.

For more information, please contact Gregg Wilson at Toll Free: 1-877-684-9700, tel: 1-604-685-9700, fax: 1-604-685-9744, email: invest@canarc.net or visit our website, www.canarc.net. The TSX Exchange has neither approved nor disapproved the contents of this news release.

CAUTIONARY DISCLAIMER – FORWARD LOOKING STATEMENTS

Certain statements contained herein regarding the Company and its operations constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. All statements that are not historical facts, including without limitation statements regarding future estimates, plans, objectives, assumptions or expectations of future performance, are “forward-looking statements”. We caution you that such “forward looking statements” involve known and unknown risks and uncertainties that could cause actual results and future events to differ materially from those anticipated in such statements. Such risks and uncertainties include fluctuations in precious metal prices, unpredictable results of exploration activities, uncertainties inherent in the estimation of mineral reserves and resources, fluctuations in the costs of goods and services, problems associated with exploration and mining operations, changes in legal, social or political conditions in the jurisdictions where the Company operates, lack of appropriate funding and other risk factors, as discussed in the Company’s filings with Canadian and American Securities regulatory agencies. The Company expressly disclaims any obligation to update any forward-looking statements. We seek safe harbour.