Each hole intersected the C vein system over broad widths and each C vein intercept contains intervals of high grade gold. The weighted average of the C vein intercepts is 0.37 oz per ton (12.7 gpt) over a 39.9 foot core length (12.2 m) and the higher grade intervals average 0.59 oz per ton gold (20.2 gpt) over an 11.6 foot core length (3.5 m), as follows.

NEW POLARIS PROJECT C VEIN SYSTEM – 2005 DRILL RESULTS

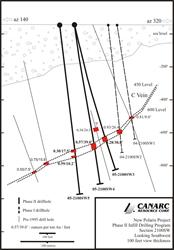

CROSS SECTION 2100SW

|

Hole (No) |

From (ft) |

To (ft) |

Interval (ft) |

Gold (oz per ton) |

|

05-2100SW-3 |

701.9 |

732.0 |

30.1 |

0.29 |

|

incl. |

703.5 |

709.0 |

5.5 |

0.53 |

|

05-2100SW-4 |

728.0 |

767.0 |

39.0 |

0.58 |

|

incl. |

732.8 |

749.9 |

17.1 |

0.79 |

|

and |

750.9 |

756.7 |

5.8 |

0.90 |

|

05-2100SW-5 |

757.5 |

808.0 |

50.5 |

0.25 |

|

incl. |

761.5 |

779.0 |

17.5 |

0.30 |

|

and |

799.0 |

808.0 |

9.0 |

0.64 |

Drilling on Section 2100SW continued down-dip from the Phase 1 drilling program, and in particular, tested an area where a previous result from 1990 suggested a vein geometry inconsistent with that indicated by subsequent pierce points. Closely spaced drill-holes 2100SW3 and 2100SW4 greatly increase the confidence of vein continuity and thickness in this area. Hole 2100SW5 successfully outlined the C veins continuity into a 300 feet long gap in drilling on this section. (see figure: Drill Section 2100SW, incl.). The C vein flattens below the deepest level (600) in the mine and has been drilled down deep for 800 feet (244 m), still open at depth.

The thicker, richer gold intercepts in the flattened zone may be amenable to lower cost, modern mechanized mining methods as compared to the shrinkage stoping carried out historically in the steeper portions of the veins. True thicknesses are estimated to be 85% to 95% of the core lengths.

The Phase 2 infill drilling program consisted of nine holes (for a total of 7733 ft or 2357 m) drilled in late 2005 on three section lines to test the C Zones starting a further 100 ft (61 m) down dip and 100 feet along strike from last year's Phase 1 in fill drilling program below the deepest mine level. One hole was terminated after significant deviation in overburden, and a planned 10th hole was cancelled on account of unsafe flying conditions. Further results from the remaining five completed holes will be available shortly.

James Moors, B.Sc., P.Geo, is the Qualified Person who supervised the 2005 drilling program on the New Polaris property. He has instituted a Quality Control sampling program of blanks, duplicates and standards to ensure the integrity of all assay results. All drill core was split by Canarc personnel at the New Polaris camp, and then flown to Vancouver for assay by ALS Chemex. The core samples were dried, crushed, split and a 30-gram subsample was taken for analysis. Gold content was determined by fire assay with a gravimetric finish on samples containing greater than 1 ppm Au, and other trace elements were analyzed by atomic absorption. ALS Chemex also uses its own standards for quality control checks.

Canarc Resource Corp. is a growth-oriented, gold exploration and mining company listed on the TSX (symbol CCM) and the OTC-BB (symbol CRCUF). The Company's principal assets are its 100% interest in the New Polaris gold deposit in British Columbia and its 80% option on the Benzdorp gold property in Suriname. Major shareholders include Barrick Gold Corp. and Kinross Gold Corp.

On Behalf of the Board of Directors

CANARC RESOURCE CORP.

/s/ Bradford J. Cooke

Bradford J. Cooke

President and C.E.O.

For more information, please contact Gregg Wilson at Toll Free: 1-877-684-9700, tel: (604) 685-9700, fax: (604) 685-9744, email: invest@canarc.net or visit our website, www.canarc.net. The TSX Exchange has neither approved nor disapproved the contents of this news release.

CAUTIONARY DISCLAIMER – FORWARD LOOKING STATEMENTS

Certain statements contained herein regarding the Company and its operations constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995. All statements that are not historical facts, including without limitation statements regarding future estimates, plans, objectives, assumptions or expectations of future performance, are "forward-looking statements". We caution you that such "forward looking statements" involve known and unknown risks and uncertainties that could cause actual results and future events to differ materially from those anticipated in such statements. Such risks and uncertainties include fluctuations in precious metal prices, unpredictable results of exploration activities, uncertainties inherent in the estimation of mineral reserves and resources, fluctuations in the costs of goods and services, problems associated with exploration and mining operations, changes in legal, social or political conditions in the jurisdictions where the Company operates, lack of appropriate funding and other risk factors, as discussed in the Company’s filings with Canadian and American Securities regulatory agencies. The Company expressly disclaims any obligation to update any forward-looking statements.